- Home

- News

- Company news

- 科(kē)技賦能保險業—區塊鏈助力互聯網保險

保險行業的發展離(lí)不開科(kē)技的助力,本周将着重探討(tǎo)如(rú)何運用區塊鏈技術(shù)促進保險業發展。當前保險行業的痛點主要集中于安全性、信息不對稱、效率低下。客戶與保險公司之間的信任問(wèn)題一直是制約保險行業發展的重要問(wèn)題。客戶信息容易被洩露,還(hái)有可(kě)能被篡改,賠付過程中可(kě)能存在重複交易或者可(kě)疑交易。客戶利用信息不對稱而存在騙保現象。傳統保險賠付過程中有大(dà)量的人(rén)工(gōng)操作環節,影(yǐng)響了賠付效率。

區塊鏈,不僅是一種技術(shù),更是一種管理(lǐ)理(lǐ)念,核心是解決個體(tǐ)與集體(tǐ)利益的協調與管理(lǐ),實現一種更加公正和**的管理(lǐ),因此,其對人(rén)類社會發展與進步的意義重大(dà),時間将證明這一點。

保險是區塊鏈技術(shù)應用的典型場景,能夠有效解決保險經營過程中的“難點”和“痛點”,同時,能夠催生出全新的商業模式。引入區塊鏈技術(shù)之後,可(kě)以提升保險業務的安全性、緩解保險業務的信息不對稱、基于智能合約有助于提升保險行業的效率。

例如(rú)保險的“**性難題”,即在保險經營過程中,面臨的一個突出問(wèn)題是保險欺詐,而保險欺詐往往都(dōu)是在“保險标的”和“保險期限”的**性上做文章(zhāng),從(cóng)标的的**性看(kàn),不是“冒名頂替”,就(jiù)是“張冠李戴”,這種情況*爲突出的是養老保險的冒領問(wèn)題。數據顯示,僅是2013年(nián),我國社保基金冒領人(rén)數達到35000人(rén),冒領金額達到1.27億元,爲此社會還(hái)需要付出額外的大(dà)量的追討(tǎo)成本。從(cóng)時間**性看(kàn),就(jiù)是“先出險,後投保”,而區塊鏈技術(shù)爲解決保險經營的“**性難題”提供了可(kě)能。

現代保險的本質是一種互助制度,互助就(jiù)是“一人(rén)爲大(dà)家,大(dà)家爲一人(rén)”,其核心是協調和處理(lǐ)個體(tǐ)與集體(tǐ)的關系,同時,信用是這種關系處理(lǐ)的基礎。由此可(kě)見(jiàn),保險與區塊鏈之間有着一種“基因性”聯系,因此,保險是區塊鏈應用的典型場景。同時,面向未來(lái),區塊鏈将更加深刻和廣泛地重構保險業。

從(cóng)區塊鏈的特點,相(xiàng)互保險是一個典型的應用場景,傳統的商業保險一般采取“前信任模式”,即客戶先交保費,出險後按照(zhào)條件(jiàn)進行賠付。而相(xiàng)互保險公司應采用的“後信任模式”,但(dàn)這種“後信任模式”在實際工(gōng)作中往往面臨信用風(fēng)險,難以逾越。利用區塊鏈的“全網共識”機(jī)制和“不可(kě)抵賴”功能,結合互聯網和大(dà)數據等技術(shù),能夠實現對信用的重構,構建一個可(kě)靠安全的信任體(tǐ)系,進而建立一個更加公平、透明、安全和**的互助機(jī)制,打造真正的相(xiàng)互保險2.0時代。面向未來(lái),基于區塊鏈等相(xiàng)關科(kē)技的有效運用,相(xiàng)互保險公司可(kě)能*終演進爲“機(jī)器保險公司”。公司的運營,不再依賴第三方的存在,完全由系統自(zì)動完成,運營平台賦予每一個個體(tǐ)以“金融”屬性,構成典型的“自(zì)保險”形态,從(cóng)而開拓相(xiàng)互保險的全新時期,進入“自(zì)保險”時代。

國際上,全球首家P2P保險”平台Lemonade、基于以太坊的P2P失業保險平台Dynamis以及全球五大(dà)保險巨頭聯合發起的B3i平台。這家打出“全球首家P2P保險”的創業公司成立于2015年(nián),位于紐約州。主要從(cóng)事(shì)财産和意外傷害保險,通過區塊鏈技術(shù),信息不會丢失,公司選擇用智能合約自(zì)動理(lǐ)賠,減少過程中的繁瑣認證過程,*快(kuài)可(kě)以三分(fēn)鍾獲得(de)賠付。目前Lemonade獲得(de)紅(hóng)杉資本有史以來(lái)*大(dà)規模種子輪融資,金額高達1300萬美元,投資方還(hái)包括軟銀、Google Venture。

我國保險業積極開展區塊鏈技術(shù)應用,中國保險業對區塊鏈技術(shù)的探索可(kě)以追溯至2016年(nián),陽光(guāng)保險、螞蟻金服、人(rén)保财險、上海保險交易所、中國人(rén)壽等來(lái)自(zì)國有保險公司、大(dà)型商業保險公司,乃至年(nián)輕的小型保險公司,都(dōu)陸續投入對區塊鏈的研究。中國人(rén)保已經開展了保險營銷和養殖保險等領域的應用,上海保交所開展了地震保險的“共保體(tǐ) + 區塊鏈”嘗試,上海保監局利用區塊鏈技術(shù),開展再保險管理(lǐ)平台探索。面向未來(lái),區塊鏈的保險應用前景廣闊。

從(cóng)應用落地的節奏來(lái)看(kàn),中美的商業保險公司、小型保險公司相(xiàng)較于大(dà)型國有保險企業,探索步伐來(lái)得(de)更快(kuài)。

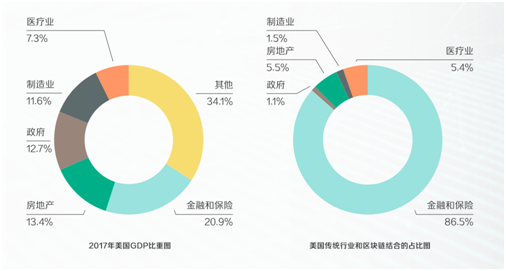

由矽谷洞察旗下矽谷洞察研究院發布《區塊鏈中美發展白(bái)皮書(shū)》中提到金融保險領域的區塊鏈創業公司數量和獲得(de)的融資額*多。矽谷洞察研究院對全球*權威的科(kē)技創新公司數據庫Crunchbase的數據進行分(fēn)析後發現,在數據庫收錄的與這五大(dà)行業相(xiàng)關的1416個區塊鏈項目中,服務于金融保險行業的區塊鏈初創項目爲1223個,占總數的86.5%。而且在披露融資數據的371家區塊鏈初創企業中,總融資額的96%是由金融保險領域的區塊鏈創業公司獲得(de)。

區塊鏈還(hái)能夠爲提供保險的運營效率,改善客戶體(tǐ)驗提出可(kě)能,區塊鏈中有一項核心技術(shù)是智能合約,它能夠大(dà)大(dà)提高保險合同執行的效率,特别是在理(lǐ)賠環節,通過智能合約技術(shù),能夠使保險理(lǐ)賠更加規範和剛性,提高客戶體(tǐ)驗水平。同時,區塊鏈的分(fēn)布式技術(shù),能夠保險理(lǐ)賠數據的交換提供更加便捷的方式,一方面是避免單證收集與交換的工(gōng)作,另一方面也能夠避免道德風(fēng)險導緻的騙賠。

同時當前區塊鏈技術(shù)落地保險業依然存在諸多難點,比如(rú)在技術(shù)層面存在擴展性問(wèn)題、安全問(wèn)題等,在非技術(shù)層面面臨着對參與者總體(tǐ)管理(lǐ)能力、觀念的挑戰、對問(wèn)責、責權分(fēn)配的挑戰、跟現有規則的沖突等一系列矛盾。

如(rú)何更好的利用區塊鏈技術(shù)解決當前保險行業的痛點,如(rú)何更好的讓區塊鏈技術(shù)落地保險業?啓明星在線将在繼續爲您帶來(lái)*新的資訊。

From :businessinsuranceU.S. commercial property/casualty rates rose 5% on average in the fourth quarter of 2019, up from 4% in the third quarter, reflecting insurers’ intent to continue to increase prices across most lines, online insurance exchange MarketScout Corp. said Monday.“Auto rate increases have been up all year long; however D&O (directors & officers) and professional rate increases have spiked significantly in the fourth quarter,” Richard Kerr, CEO of MarketScout Corp. said in a statement.Insurers are carefully analyzing their property exposures using catastrophe modeling tools, he said. “We expect many of the major property catastrophe insurers to curtail their 2020 writings in California brush and East and Gulf Coast wind areas. Naturally, this will result in higher rates to insureds,” Mr. Kerr said.D&O liability rates increased by 8.25%, while commercial auto increased 8% in the quarter, and professional liability rates were up 6%, and umbrella/excess rates were up 5.5%, according to MarketScout.Commercial property rates increased 5.25% in the quarter, and business interruption rates were up 5%, while all other lines showed smaller increases, except for workers compensation, where rates fell 1%, MarketScout said.By industry class, transportation and habitational saw the highest average rate increases at 9% and 8.25% respectively, MarketScout said.Large accounts – those with $250,001 to $1 million in premium – saw a rate hike of 5.5% in the fourth quarter, as did jumbo accounts, which have more than $1 million in premium. Small accounts – those with up to $25,000 in premium – were up 5%, while medium accounts – those with $25,001 to $250,000 in premium – were up 4.5%.The “steady trend” of upward rates reflects insurers’ plans to continue increasing prices across all lines except for workers compensation, MarketScout said.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

From :insurancejournalIt was a relatively quiet year for the Southeast in terms of major catastrophes compared with 2018 when Hurricane’s Michael and Florence caused major damage in the region. This year, Hurricane Dorian sideswiped the Southeast coast and made landfall on the Outer Banks of North Carolina but most of the area was spared. Still, Aon said economic damage in the U.S. and Canada was poised to approach a combined $1.5 billion.Florida spent the year recovering from Hurricane Michael, which was upgraded to a Category 5 storm by NOAA in April. Florida officials have repeatedly called on the insurance industry to speed up the recovery process, with nearly 12% of claims still open a year after the storm hit.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

From:businessinsuranceeinsurance renewals at Jan. 1, 2020, mainly saw single-digit increases, with some exceptions, according to reports by reinsurance brokers released Thursday.Willis Re, the reinsurance brokerage of Willis Towers Watson PLC, and Guy Carpenter & Co. LLC, a unit of Marsh & McLennan Cos. Inc. both reported that year-end reinsurance renewals varied by account and region, but the retrocessional reinsurance was under pressure.Rates on line for property catastrophe reinsurance programs remained stable and property per risk pricing was driven by individual program performance, the Willis report said.Although some Lloyd’s of London syndicates took firm positions on rate increases and the London market authorized capacity decreased, that capactiy was replaced by new capital and a strong supply from other markets, Willis Re said.U.S. loss-free accounts renewed at flat to up 10% while those with losses saw increases of 10% to 50%, the Willis Re report said, which was among the largest increases. Property catastrophe accounts without losses renewed at flat to up 5%, while loss hit accounts were up 10% to 20%, Willis Re said.According to the Guy Carpenter report, the brokerage’s global property catastrophe rate on line index rose 5% in 2019.According to the Willis Re report, other large increases were seen in Central and Eastern Europe, where property programs with losses saw increases of 5% to 20%, and Canada, where such accounts renewed up 10% to 40%.Most other regions and countries saw property increases in the single or low double digits, the report said.The Jan. 1 renewals saw some “difficult” negotiations, according to a letter in the report from James Kent, global CEO, Willis Re.The Guy Carpenter report said the reinsurance market was “asymmetrical,” adding “this is certainly not a one-size-fits-all market” and while overall capacity remained adequate, “allocated capacity tightened notably in stressed classes.”Dedicated reinsurance capital rose 2% in 2019 and the year saw approximately $60 billion in global insured catastrophe losses, according to Guy Carpenter, which was significantly lower than 2017 and 2018.Alternative capital, however, contracted by approximately 7% percent “as investors were more cautious with new investments after assessing market dynamics and pricing adequacy,” Guy Carpenter said.The retrocession market “was challenged … by trapped capital, a lack of new capital and continued redemptions from third-party capital providers,” a statement issued with the Guy Carpenter report said.However, significant retrocession providers returned to the market in the past two weeks, Willis Re said.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

Major information technology companies in India are running the risk of termination of their $1 billion contracts following Boeing Co.’s decision to halt the production of its 737 Max jets, MoneyControl reported citing the Business Standard. Companies like Tata Consultancy Services Ltd., Infosys Ltd., HCL Technologies Ltd., Cyient Ltd. and L&T Technology Services Ltd. have outsourcing contracts with Boeing or its suppliers and Boeing’s jet crisis is expected to affect these IT companies in the short run.From:businessinsuranceOrganizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

France-based eyewear maker Essilor International S.A. has discovered fraudulent activities at one of its factories in Thailand that could cause €190 million ($213 million) in financial losses to the company, The Irish Times reported citing Reuters. The company has filed complaints in Thailand and has fired all the involved employees. It hopes to recover the losses from frozen bank accounts, insurance and lawsuits.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305