- Home

- News

- Company news

- 輔助還(hái)是代替,保險+人(rén)工(gōng)智能展望

你(nǐ)有沒有想過,某天你(nǐ)所在的行業将被機(jī)器替代,或許有一天人(rén)工(gōng)智能将取代某些行業。作爲專業性較強的保險行業與人(rén)工(gōng)智能結合,将會發生什麽化學反應?未來(lái)保險行業是否會被人(rén)工(gōng)智能替代呢(ne)?

複旦大(dà)學中國保險科(kē)技實驗室發布《人(rén)工(gōng)智能保險行業運用路(lù)線圖》,人(rén)工(gōng)智能保險行業發展的時間軸可(kě)劃分(fēn)爲三個階段:2006年(nián)起,我國保險業開始進入電子化時代(2006-2015),随之是自(zì)動化時代(2015-2018),直到2018年(nián)開始進入智能化時代(2018及以後)。智能化時代又需要跨過弱智能(2018-2020)和中智能(2020-2030)兩個階段,*終達到強智能時代(2030及以後)。

人(rén)工(gōng)智能的運用,将對保險業有哪些影(yǐng)響:

其一,人(rén)工(gōng)智能對保險客戶服務的影(yǐng)響。從(cóng)用戶接受服務的角度來(lái)說(shuō),保險行業的服務流程主要包括産品設計(jì)、銷售、承保、投保、理(lǐ)賠、售後服務等;從(cóng)保險公司持續健康發展的角度來(lái)說(shuō),必然離(lí)不開精算、風(fēng)險控制、保險資金運用等工(gōng)作環節。在這些服務流程和工(gōng)作環節中,人(rén)工(gōng)智能正逐漸找到自(zì)己的位置并産生了不可(kě)忽視的影(yǐng)響。

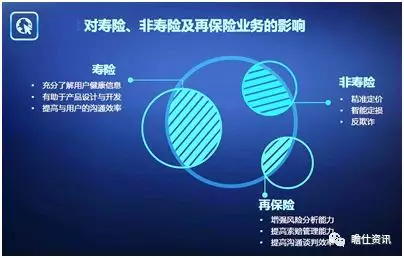

其二,人(rén)工(gōng)智能對保險核心業務的影(yǐng)響。人(rén)工(gōng)智能對壽險、非壽險及再保險業務也具有不同的影(yǐng)響。借助基因檢測,可(kě)穿戴智能設備等技術(shù)和手段,搜集被保險人(rén)全方面健康數據,并将收集來(lái)的信息與人(rén)們生會變化規律相(xiàng)結合,推算出被保險人(rén)的身(shēn)體(tǐ)健康狀況和生命周期特征,從(cóng)而有利于調整考驗産品結構、對被保險人(rén)健康狀況進行主動有效的管理(lǐ),讓壽險産品的融資功能和保障功能實現有機(jī)融合;在非壽險領域,人(rén)工(gōng)智能主要改變了原來(lái)的風(fēng)險管理(lǐ)和風(fēng)險識别的手段,拓展了保險覆蓋範圍,也催生了大(dà)量基于各類場景的業務形态的出現;對于再保險公司來(lái)說(shuō),人(rén)工(gōng)智能在身(shēn)份識别管理(lǐ)、自(zì)動化保險理(lǐ)賠及反欺詐等領域的優勢,将增強再保險公司的風(fēng)險分(fēn)析和索賠管理(lǐ)能力,從(cóng)而降低再保業務的審定難度,提高保險公司和再保險公司的溝通效率,未來(lái)還(hái)可(kě)能依托區塊鏈、大(dà)數據和人(rén)工(gōng)智能技術(shù)打造再保險交易平台,将對傳統再保險市場形成不可(kě)忽視的替代作用。

其三,人(rén)工(gōng)智能對保險從(cóng)業人(rén)員(yuán)的影(yǐng)響。人(rén)工(gōng)智能正逐步滲透到保險業的方方面面,保險公司在享受人(rén)工(gōng)智能帶來(lái)的效率提升的同時,世界各地的保險從(cóng)業者也将面對人(rén)工(gōng)智能可(kě)能對就(jiù)業帶來(lái)的沖擊。

人(rén)工(gōng)智能時代已經到來(lái),下一步有可(kě)能是人(rén)工(gōng)智能爆發式發展的時期。保險行業應具體(tǐ)重哪些層面運用。從(cóng)應用場景來(lái)講,大(dà)緻可(kě)以分(fēn)爲三個層面:

第一,直接面向*終的保險客戶。保險客戶有一個說(shuō)法,叫做保險客戶的客戶關鍵旅程,他(tā)在跟保險公司交互的客戶關鍵旅程,無外乎是從(cóng)一開始的獲取保險産品相(xiàng)關信息,到咨詢、投保,接下來(lái)可(kě)能就(jiù)會有核保,核保之後,生效之後如(rú)果有意外發生,會有理(lǐ)賠,會有增值服務等等。在這樣客戶關鍵旅程裡(lǐ)面,我舉了一些*典型的人(rén)工(gōng)智能應用,可(kě)以看(kàn)到其實到現在爲止應該說(shuō)保險公司在這些領域都(dōu)已經有人(rén)工(gōng)智能産品已經上線在應用了。這其中的運用包含智能投保顧問(wèn),統一身(shēn)份認證,人(rén)臉識别,聲聞識别,圖象識别,智能核保,智能定損,智能理(lǐ)賠等。

第二,基于供應鏈的人(rén)工(gōng)智能應用。保險的産品在人(rén)工(gōng)智能時代也面臨着升級,人(rén)工(gōng)智能能對他(tā)的推動使得(de)這個産品能夠做更加多的個性化的定制。另外在風(fēng)控領域其實人(rén)工(gōng)智能應用也非常多,這個裡(lǐ)面包含了通過對大(dà)量的客戶理(lǐ)賠案例的客戶畫(huà)像建立,通過各種模型跟因子的建立,*後能夠建立起風(fēng)控模型,及時辨識出來(lái)一些有風(fēng)險的理(lǐ)賠客戶,及時的預警,防止在理(lǐ)賠方面的一個更大(dà)損失。具體(tǐ)應用體(tǐ)現在,智能投研,智能投顧。

第三,智能招聘。保險業都(dōu)有開門(mén)紅(hóng),每年(nián)的開門(mén)紅(hóng)都(dōu)是會帶來(lái)巨量的保費收入,在巨量保費收入的背後,每一年(nián)第四個季度大(dà)家都(dōu)在忙着做營銷員(yuán)的招聘,衆所周知,營銷員(yuán)的流失率非常高,招聘的數量真的是海量,人(rén)工(gōng)智能的運用将大(dà)大(dà)的縮減相(xiàng)關時間,人(rén)力,資源成本。

人(rén)工(gōng)智能在保險業的運用尚屬于發展初期,面臨着衆多挑戰。

第一,政策監管障礙。衆多保險公司、科(kē)技公司都(dōu)在涉足人(rén)工(gōng)智能保險相(xiàng)關領域,但(dàn)整個行業沒有統一的标準。監管層面上,目前暫時沒有對人(rén)工(gōng)智能在保險行業的運用制定明确的監管法規,監管的空白(bái)使得(de)人(rén)工(gōng)智能保險行業的運作秩序得(de)不到保障。

第二,數據障礙。目前保險行業的數據庫缺乏廣度和深度,曆史數據在質量和數量上遠(yuǎn)遠(yuǎn)達不到大(dà)規模運用人(rén)工(gōng)智能的程度,數據孤島現象嚴重,産品銷售端和服務端往往無法獲取,影(yǐng)響人(rén)工(gōng)智能質量。

第三,市場障礙。首先,人(rén)工(gōng)智能将會對保險代理(lǐ)人(rén)群體(tǐ)産生沖擊,這個群體(tǐ)十分(fēn)龐大(dà),利益相(xiàng)關者短(duǎn)期可(kě)能會阻礙人(rén)工(gōng)智能與保險的結合;此外,傳統保險公司的經營理(lǐ)念桎梏是一個潛在問(wèn)題,我國保險行業本身(shēn)潛在市場還(hái)很大(dà),大(dà)衆接受正常的保臉産品尚且不易,接受人(rén)工(gōng)智能保險産品則更難。*後,人(rén)工(gōng)智能技術(shù)的應用深度不夠,除了特定領域,比如(rú)語音識别、人(rén)臉識别等方面,其他(tā)領域運用并不廣泛,隻有全行業廣泛應用的風(fēng)潮到來(lái),保險行業才會迎來(lái)質的發展。

第四,研發或技術(shù)障礙。人(rén)工(gōng)智能目前處于發展階段,技術(shù)研發成本高,研發期長,雖然目前人(rén)工(gōng)智能在感知智能層面越來(lái)越成熟,但(dàn)是與真正運用到實業,和保險深入契合,還(hái)存在一段距離(lí)。同時保險是一個多學科(kē)知識結合的學科(kē),需要全方位的知識,面目前人(rén)工(gōng)智能隻能支持單方面的智能,還(hái)難以做到和人(rén)類一樣多方向思考。

第五,信息安全問(wèn)題。人(rén)工(gōng)智能保險運用中需要考慮投保人(rén)的信息隐私保護問(wèn)題和安全問(wèn)題,即保險公司獲取投保人(rén)某方面的信息是否合法合理(lǐ),是否存在洩露的風(fēng)險。目前,保險公司在建設安全壁壘、保護好客戶和保險公司的數據信安全方面存在不足。

人(rén)工(gōng)智能的發展,對于保險業來(lái)說(shuō)是挑戰也是機(jī)遇,雖然目前仍然處于初步應用,但(dàn)未來(lái)發展可(kě)期。2019中國互聯網保險創新峰會(CIIS2019)将在4.11-12爲您帶來(lái)保險+人(rén)工(gōng)智能的運用及暢想。

From :businessinsuranceU.S. commercial property/casualty rates rose 5% on average in the fourth quarter of 2019, up from 4% in the third quarter, reflecting insurers’ intent to continue to increase prices across most lines, online insurance exchange MarketScout Corp. said Monday.“Auto rate increases have been up all year long; however D&O (directors & officers) and professional rate increases have spiked significantly in the fourth quarter,” Richard Kerr, CEO of MarketScout Corp. said in a statement.Insurers are carefully analyzing their property exposures using catastrophe modeling tools, he said. “We expect many of the major property catastrophe insurers to curtail their 2020 writings in California brush and East and Gulf Coast wind areas. Naturally, this will result in higher rates to insureds,” Mr. Kerr said.D&O liability rates increased by 8.25%, while commercial auto increased 8% in the quarter, and professional liability rates were up 6%, and umbrella/excess rates were up 5.5%, according to MarketScout.Commercial property rates increased 5.25% in the quarter, and business interruption rates were up 5%, while all other lines showed smaller increases, except for workers compensation, where rates fell 1%, MarketScout said.By industry class, transportation and habitational saw the highest average rate increases at 9% and 8.25% respectively, MarketScout said.Large accounts – those with $250,001 to $1 million in premium – saw a rate hike of 5.5% in the fourth quarter, as did jumbo accounts, which have more than $1 million in premium. Small accounts – those with up to $25,000 in premium – were up 5%, while medium accounts – those with $25,001 to $250,000 in premium – were up 4.5%.The “steady trend” of upward rates reflects insurers’ plans to continue increasing prices across all lines except for workers compensation, MarketScout said.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

From :insurancejournalIt was a relatively quiet year for the Southeast in terms of major catastrophes compared with 2018 when Hurricane’s Michael and Florence caused major damage in the region. This year, Hurricane Dorian sideswiped the Southeast coast and made landfall on the Outer Banks of North Carolina but most of the area was spared. Still, Aon said economic damage in the U.S. and Canada was poised to approach a combined $1.5 billion.Florida spent the year recovering from Hurricane Michael, which was upgraded to a Category 5 storm by NOAA in April. Florida officials have repeatedly called on the insurance industry to speed up the recovery process, with nearly 12% of claims still open a year after the storm hit.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

From:businessinsuranceeinsurance renewals at Jan. 1, 2020, mainly saw single-digit increases, with some exceptions, according to reports by reinsurance brokers released Thursday.Willis Re, the reinsurance brokerage of Willis Towers Watson PLC, and Guy Carpenter & Co. LLC, a unit of Marsh & McLennan Cos. Inc. both reported that year-end reinsurance renewals varied by account and region, but the retrocessional reinsurance was under pressure.Rates on line for property catastrophe reinsurance programs remained stable and property per risk pricing was driven by individual program performance, the Willis report said.Although some Lloyd’s of London syndicates took firm positions on rate increases and the London market authorized capacity decreased, that capactiy was replaced by new capital and a strong supply from other markets, Willis Re said.U.S. loss-free accounts renewed at flat to up 10% while those with losses saw increases of 10% to 50%, the Willis Re report said, which was among the largest increases. Property catastrophe accounts without losses renewed at flat to up 5%, while loss hit accounts were up 10% to 20%, Willis Re said.According to the Guy Carpenter report, the brokerage’s global property catastrophe rate on line index rose 5% in 2019.According to the Willis Re report, other large increases were seen in Central and Eastern Europe, where property programs with losses saw increases of 5% to 20%, and Canada, where such accounts renewed up 10% to 40%.Most other regions and countries saw property increases in the single or low double digits, the report said.The Jan. 1 renewals saw some “difficult” negotiations, according to a letter in the report from James Kent, global CEO, Willis Re.The Guy Carpenter report said the reinsurance market was “asymmetrical,” adding “this is certainly not a one-size-fits-all market” and while overall capacity remained adequate, “allocated capacity tightened notably in stressed classes.”Dedicated reinsurance capital rose 2% in 2019 and the year saw approximately $60 billion in global insured catastrophe losses, according to Guy Carpenter, which was significantly lower than 2017 and 2018.Alternative capital, however, contracted by approximately 7% percent “as investors were more cautious with new investments after assessing market dynamics and pricing adequacy,” Guy Carpenter said.The retrocession market “was challenged … by trapped capital, a lack of new capital and continued redemptions from third-party capital providers,” a statement issued with the Guy Carpenter report said.However, significant retrocession providers returned to the market in the past two weeks, Willis Re said.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

Major information technology companies in India are running the risk of termination of their $1 billion contracts following Boeing Co.’s decision to halt the production of its 737 Max jets, MoneyControl reported citing the Business Standard. Companies like Tata Consultancy Services Ltd., Infosys Ltd., HCL Technologies Ltd., Cyient Ltd. and L&T Technology Services Ltd. have outsourcing contracts with Boeing or its suppliers and Boeing’s jet crisis is expected to affect these IT companies in the short run.From:businessinsuranceOrganizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305

France-based eyewear maker Essilor International S.A. has discovered fraudulent activities at one of its factories in Thailand that could cause €190 million ($213 million) in financial losses to the company, The Irish Times reported citing Reuters. The company has filed complaints in Thailand and has fired all the involved employees. It hopes to recover the losses from frozen bank accounts, insurance and lawsuits.Organizer:China Insurance Digital & AI Development 2020Web:http://en.zenseegroup.com/p/560573/Contact:Ann 021-65650305